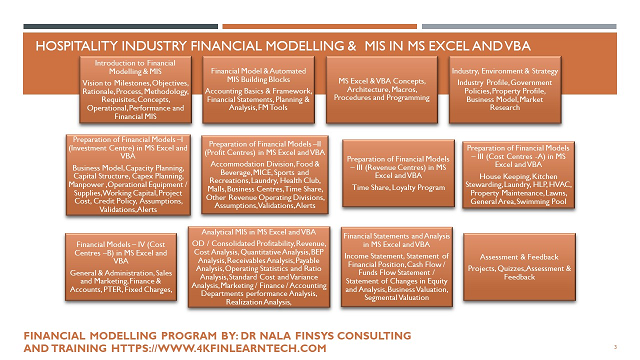

Module Aim

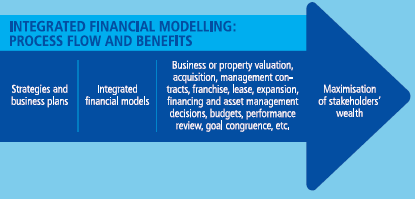

This course is designed to provide candidates with an overview of the presentation and disclosures of financial statements and an advanced knowledge of selected important accounting standards.

Syllabus Learning Outcomes

Candidates will be able to:

Understand the framework for the preparation and presentation of financial statements and the disclosure issues.

Identify the basic and further issues in the preparation of consolidated financial statements. Understand the basic concepts of deferred tax accounting, the disclosures and presentation issues.

Understand the concepts relating to foreign currency transactions and translation.

Account for financial instruments.

Understand emerging or other accounting issue

Module outline and detailed syllabus

1. Overview of Financial Statements

Framework for the preparation and presentation of financial statements

Objective of financial statements

Qualitative characteristics of financial statements

Recognition and measurement of the elements of financial statements

Concepts of capital and capital maintenance

Financial statements

Statement of Financial Position

Statement of Comprehensive Income

Concept of comprehensive income

Income Statement

Statement of Cash Flows

Statement of Changes in Equity

Notes to accounts

Other disclosure issues in the financial statements

Changes in accounting policy and estimates and correction of errors

Events after the balance sheet date

Provisions, contingent liabilities and contingent assets

Operating segments

Related party disclosures

Earnings per share

2. Consolidated Financial Statements

Basic issues in the preparation of consolidated balance sheet and consolidated income statement

The acquisition method Goodwill on consolidation

Fair value adjustments

Non-controlling interests

Inter-company transactions and unrealised gains/losses

Further issues in the preparation of consolidated balance sheet and consolidated income statement

Investments in associates and equity accounting

Loss of control

Re-measurement of previously-held interests on acquisition date

Reverse take-overs

Complex group structure (e.g. father-son-grandson structure)

Interests in joint-ventures

3. Accounting for Income Taxes

Basic concepts in deferred tax accounting

Rationale for deferred tax accounting

Concept of tax base and temporary differences

Taxable and deductible temporary differences

Recognition of deferred tax assets/liabilities

Accounting for temporary differences

Recognized assets and liabilities in separate financial statements

Revaluation of recognized assets and liabilities in separate financial statements

Initial recognition of assets and liabilities in separate financial statements

Fair value adjustments recognized under the acquisition method in consolidated financial statements

Goodwill

Investment in subsidiaries and associates

Accounting for deferred tax assets

Accounting for tax losses

Deductible temporary differences

Measurement issues

Measurement of deferred tax assets/liabilities

Measurement of tax expense

Presentation issues

Presentation of current tax payable

Presentation of deferred tax assets/liabilities

Presentation of tax expense

Disclosure requirements

Reconciliation of effective tax rate/amount to statutory tax rate/amount

Analysis of temporary differences

Other disclosures

4. Foreign Currency Transaction and Translation

Foreign currency transactions and balances

Concepts relating to functional currency and presentation currency

Translation of foreign currency transactions and balances into an entity’s functional currency

Monetary items versus non-monetary items

Treatment of exchange gains/losses

Foreign operations

Re-measurement of foreign currency financial statements to the functional currency

Translation of financial statements prepared in an entity’s functional currency to a different presentation currency

Translation of foreign currency financial statements of subsidiaries and associates to the presentation currency of the parent

Translation gains and losses arising from translation of the separate financial statements of a subsidiary or an associate

Translation gains and losses arising from the translation of goodwill and fair value adjustments

Allocation of translation gains and losses to non-controlling interests

5. Accounting for Financial Instruments

Theoretical and practical considerations underlying the application of FRS 32, FRS 39 and FRS 107

Recognition and derecognition

Recognition of financial assets: primary instruments and derivative instruments, stand-alone and embedded derivatives

Recognition of financial liabilities

Derecognition of financial assets and liabilities

Measurement

Measurement of financial assets: “fair value through profit or loss”, “available-for-sale”, “held-to-maturity”, and “loans and receivables”

Measurement of financial liabilities

Presentation

Substance over form

Split accounting for compound instruments

Off-setting of financial assets and financial liabilities

Disclosure

Risk management policy

Fair values

Other disclosures

Hedge accounting

Fair value hedge

Cash flow hedge

Hedge of investment in foreign entity

6. Emerging or Other Accounting Issues

This topic deals with conceptual and qualitative issues relating to:

IFRS 9 Financial Instruments

Compensation-related issues including accounting for share-based compensation

Issues addressed in exposure drafts (ED/FRS and ED/INT FRS) that have significant impact on future accounting practices

Contentious or evolving issues relating to Topics 1- 5 of this syllabus