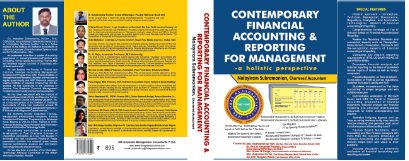

Contemporary accounting and integrated reporting - a holistic managerial perspective

Preface

Preface

This book, ‘Contemporary Accounting and Integrated Reporting for Management’ has been conceptualized, developed and written as is appropriate for the current scenario and the perspectives which the subject of ‘financial accounting’ consists of. While the basic method of financial accounting has not changed, the environments within which the domains of Financial Accounting operate have been undergoing dynamic changes. Some concepts such as, ‘fair value accounting’ even though old, are gaining renewed and higher impetus.

Business entities have on an increasing scale been becoming global and crossing boundaries resulting in requirement of compliance with different financial reporting frameworks. With more than 120 nations across the world directing / supporting harmonization of financial reporting standards with IFRS, need for convergence has been increasingly felt and accepted. Indian Government is just to announce the effective date of implementation of Ind AS – the equivalent of IFRS. ‘Financial Ac- counting’ is becoming more of a multi-responsibility centre than having just remained as a cost centre. The role of ‘accounting’ in creating value addition to the business entity in terms of reliable financial reporting and management reporting is being recognized from an appropriate perspective. Accounting, which was once carried out only at the location of the business premises has matured to be ‘virtually portable’ accompanied by favorable and unfavorable outcomes. One of the favorable outcomes is ‘human resources development’ in the ‘sourcing destination’, basically on account of opportunities to acquire knowledge of different financial reporting frameworks such as national ac- counting frameworks, IFRS, US GAAP etc. On the other side, the important outcome is increasing threats to availability and integrity of data and thereby resulting in negative impact on reliability of financial reporting of a business entity (eg: Enron and erstwhile Satyam Computers).

If one looks at practicing accountants and managers, a transformation is taking place in terms of the need on their part to update the extent of the knowledge both horizontally as well as vertically. In terms of vertical perspective, they need to learn new reporting requirements of frameworks such as Ind AS, IFRS, US GAAP, Companies Act 2013 etc. Horizontally, the accountants need to learn/update spreadsheet skills including that of financial modeling and other computer based interactive skills. Besides, the new developments with respect to reporting requirements expect the people charged with governance of business entities to play a better and higher proactive role, necessitating the members of the Board of Directors of Companies, more so in the case of companies listed in stock exchanges to understand their increasing responsibility, at the macro level.

The ‘new generation’ investing community such as IT Professionals is venturing into capital markets, many of whom do not get adequate opportunity to learn about concepts of financial accounting and financial accounting & reporting practices of business entities.

Scope of financial accounting & reporting does not end with just preparation of financial statements. A cycle of financial reporting gets completed only when financial statements are approved by the shareholders, subsequent to consideration of reports of the Auditors and interpretation of relationships between various elements of financial statements, albeit to a limited extent by the management takes place. I felt that there is a need to explain the process of financial reporting.

Accounting for taxes has been traditionally kept out of discussion in most of the books on financial accounting. However, the author strongly believes that a manager and members charged with governance need to know implications of accounting policies on tax liability of a business at least from the point of a bird’s eye view.

It is in the above scenario that Graduate / Post Graduate Students of Management Programme or of Accounting & Finance are learning the subject of financial accounting and reporting. They need to learn state of the scenario of ‘financial accounting and reporting’ to equip themselves to be future managers.

Financial Accounting and reporting process of an entity cannot be studied in isolation without com- prehending the accounting information system of a business entity. A recent Indian Accounting Scam, involving a software company is an example of how the Accounting Information Systems can be manipulated to produce ‘coherent misrepresentation’ of financial information in aid of fraudulent re- porting practices. A standard book normally does not include a discussion on ‘accounting information systems’.

Thus, the author felt that there is a vacuum with respect to a comprehensive book that covers afore- said aspects of financial accounting and reporting in the contemporary scenario. It is the result of this need, the book ‘Contemporary Financial Accounting and Reporting for Management – a holistic perspective’, encompassing conceptual, technical, technological, managerial, regulatory, governance, compliance and analytical aspects of financial accounting and reporting has been conceptualized, developed and written on the basis of his experience in the fields of financial accounting & reporting, financial management and information systems as a practitioner both in industry and as an in- dependent practitioner, as an academician in leading business schools such as National Institute of Industrial Engineering (NITIE, Mumbai), St. Francis Institute of Management and Research, Mumbai and Mumbai University, as a resource person for valuation course of the Institute of Chartered Accountants of India and as a corporate trainer in the areas of financial reporting standards and financial modeling, cumulatively for more than quarter of a century.

Methodology followed in Development of the book

The subject of ‘financial accounting and reporting’ basically is concerned with the process of financial and other relevant information delivery. It consists of four important parts. In the order of importance, one may list them as: concepts, process, contents and structure. Extent of quality of contents of financial statements depends to a large extent the effectiveness of the governance of accounting and reporting process such as preparation, validation, authentication, attestation (audits) and approval of financial statements, even though the minimal structure and level of contents are decided by financial reporting standards, respective laws governing an entity or other generally accepted accounting practices. It also goes without saying that clarity of understanding with respect to basic concepts of accounting and of characteristics of financial elements qualifying for recognition, measurement, presentation, de-recognition and disclosure is of fundamental importance.

This book has given appropriate coverage of all those parts of the subject. Appropriate references to reporting standards such as IFRS, Ind AS, Existing AS and requirements of Companies Act 2013 have been provided to render as much practical perspectives as possible to the subject. Besides, illustrative areas of application of spreadsheet on a day today basis as well as with reference to financial modeling in preparation of projected financial statements have been explained in the book. In order to make the reader stay ahead, terminologies as are relevant to contemporary financial accounting and reporting have been explained elaborately. In order to enable easier and in-depth understanding of the subject, various aids including the following have been provided.

Modular approach has been followed in relation to preparation and maintenance of ledgers

Insets providing descriptive explanations of concepts Simple illustrations explaining individual concepts Elaborate illustrations based on published accounts Exercises

Live Cases

Illustrative Spread Sheet application with the help of Micro Soft Excel

Illustrative VBA Programming for Micro Soft Excel

Web based learning resources